Finally a 100% Swiss Made software to Wealth Management – one that really simplifies your life.

USD 9K

We think it’s way too much.

You too?

Banks

Efficience has made agreements with over forty custodian banks to allow you to manage all of your clients’ assets and bank accounts on a single platform.

In one click, you can generate comprehensive reports, aggregating multiple data from different environments.

Security

Designed and developed in Switzerland, Efficience fully meets the strictest specifications in terms of confidentiality criteria. The Efficience solution is already securely installed in IT departments at more than 60 industry leaders.

Bespoke

Audit

We are able to deliver reports and documents to accompany audit requests, in line with the directives of regulatory authorities and international standards. Be prepared for your audit LSFin – LEFin, MIFID II, DIFC, ADGM.

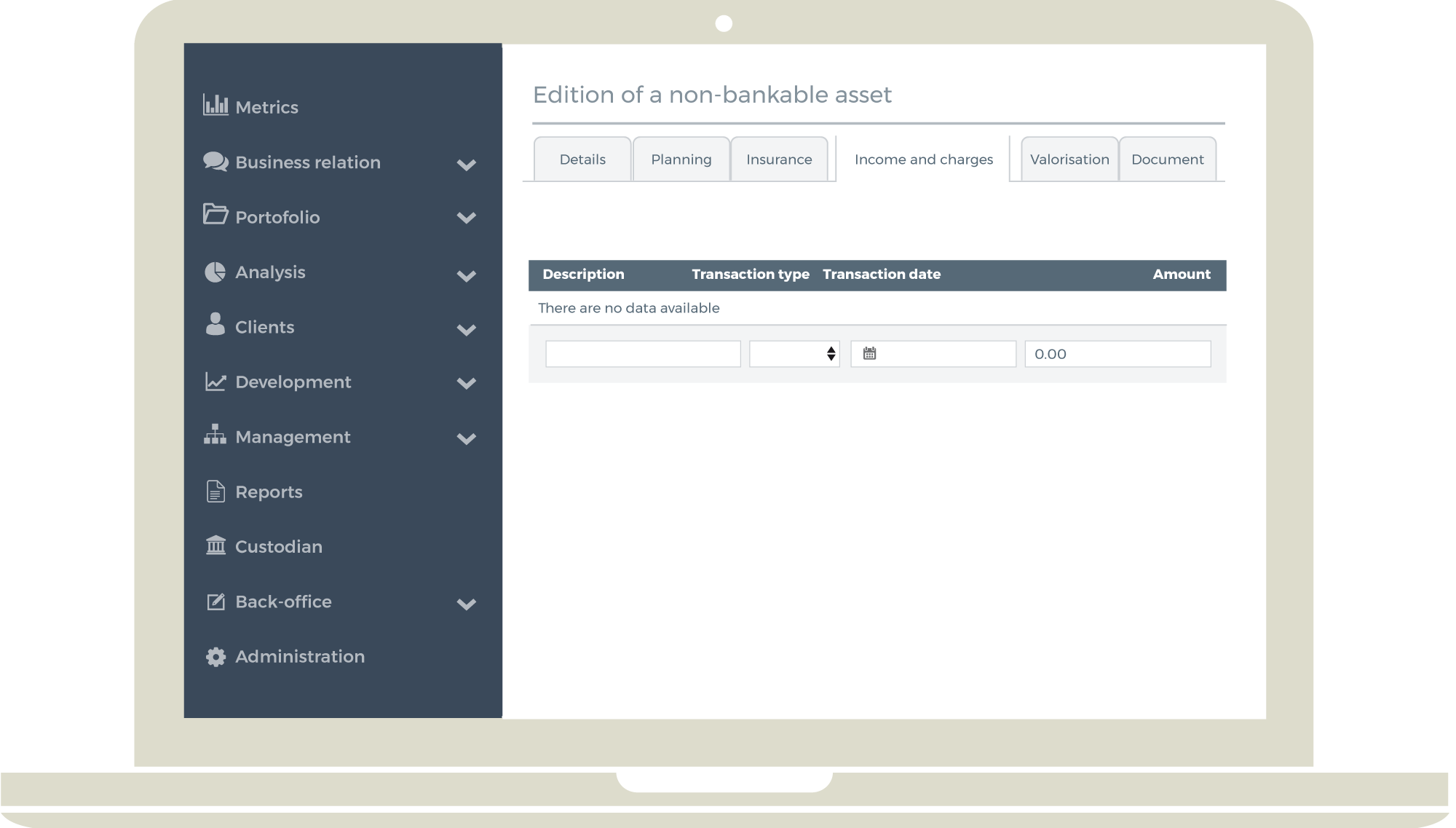

Asset management

- Portfolio Analysis, Monitoring and Investment Proposal

- Consolidation statement

- Daily Flow of data from more than 40 custodian bank

- Monitoring of the Risk profile, actual asset allocation and securities alerts on change of pricing

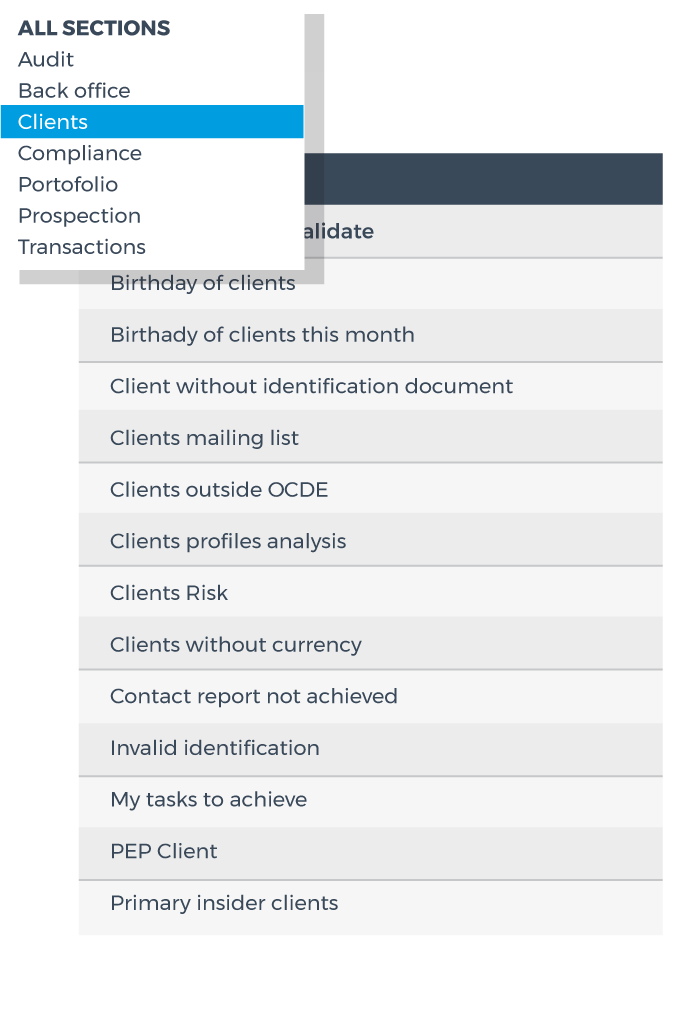

CRM

- Client Relationship Management tool with Know Your Client and Anti Money Laundry

- State-of-the art dashboard to monitor your business

- Dedicated access to your team members

- Audit and reporting in line with regulators such as FINMA, FCA, DIFC, ADGM

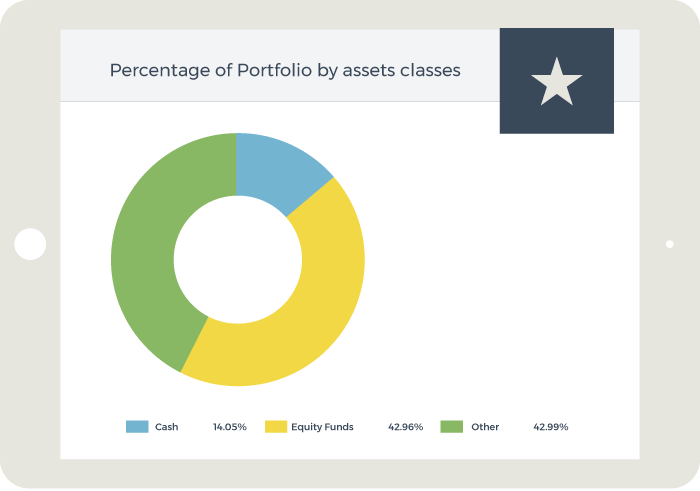

Apps for iPad

- Consolidated view in white labelling

- Daily Flow of data from the custodian banks

- Portfolio, transaction, asset class, region and currencies breakdown

- Secured environment

How to benefit from Efficience?

It is very easy to benefit from all the advantages of our solution!

1

You make an appointment for an assessment with one of our engineers

2

We carry out a complete audit of your needs

3

We install and configure the solution in collaboration with your team

Efficience BlogPosts

Webinar Investment Risk Management

WEBINAR 1 Investment Risk Management In the video below, Bruno Fievet’s full intervention (in french). Efficience BlogPosts

read moreLSFIN, LEFIN & The Key S.A.

SPHERE SWISS LSFIN, LEFIN & The Key S.A.: The key is... In this blog’s article, you’ll find Bruno Fievet full article available in the November issue of Sphere magazine, dedicated to Finance. Our digital solution allows you to consolidate your clients' assets,...

read moreThe Efficience Webinar

NEW The Efficience Webinars This year, our objective is to offer several Webinars built to deepen the key points of our Efficience solution. Fortunate to have customers from all over the globe, we are happy to bring them together for training and information sessions...

read moreEfficience Key Features

Client Relationship Management tool with Know Your Client and Anti Money Laundering

- State-of-the-art dashboard to monitor your business

- Consolidated statement in white labelling

- Manage all types of customers and prospects from Natural Person, Trust, Foundations to Life Insurance

- Dedicated section for Know Your Client and Anti Money Laundry

- Provide access to your client to his consolidated assets

- Ipad apps in white labelling

- Archiving of account opening and identification formalities

- Automated calculation of all periodic fees

- Generate invoices

- Dedicated access to your team members and deputy

- and more…

Audit and Reporting

- Production of dedicated listing made in collaboration with big four auditor firms

- In line with regulation such as FINMA, FCA, DIFC, ADGM

- Flow of Funds monitoring with approval process and attachement of corroboration file

- Transaction and journal monitoring

- Index scoring/classification of the Anti Money Laundry country risk index

- Daily name and company check from Factiva integration

- Compliance alert on documentation, name or portfolio risk

- Certified compliance Advisor services

- Provide your auditor with a dedicated access to the tool

- and more…

Portfolio Analysis, Monitoring and Investment Proposal

- Daily Flow of data from more than 40 custodian banks

- Control of data prior loading to software

- Monitoring of the Risk profile and actual asset allocation

- Monitoring of concentration risk

- Securities alerts on change of pricing

- Portfolio and transaction breakdown

- Dedicated reporting

- Calculation of performance

- Manage your Model Portfolio

- Create Investment Proposal

- and more…