Efficience’s Tutorials

In this section you will find several tips to get you started with Efficience.

Tutorial

Create the business relationship

The business relationship is considered as a workbook in the Efficience software. This is where the client(s) with their portfolio(s) as well as all documentation related to the bank and the client will be listed.

Tutorial

Create a new customer

Tutorial

Create the custodian bank

This tutorial is required to add a new bank to the Efficience software. The portfolio related bank must be present before a new portfolio is created.

Tutorial

Create portfolios

Tutorial

Attach documents

Tutorial

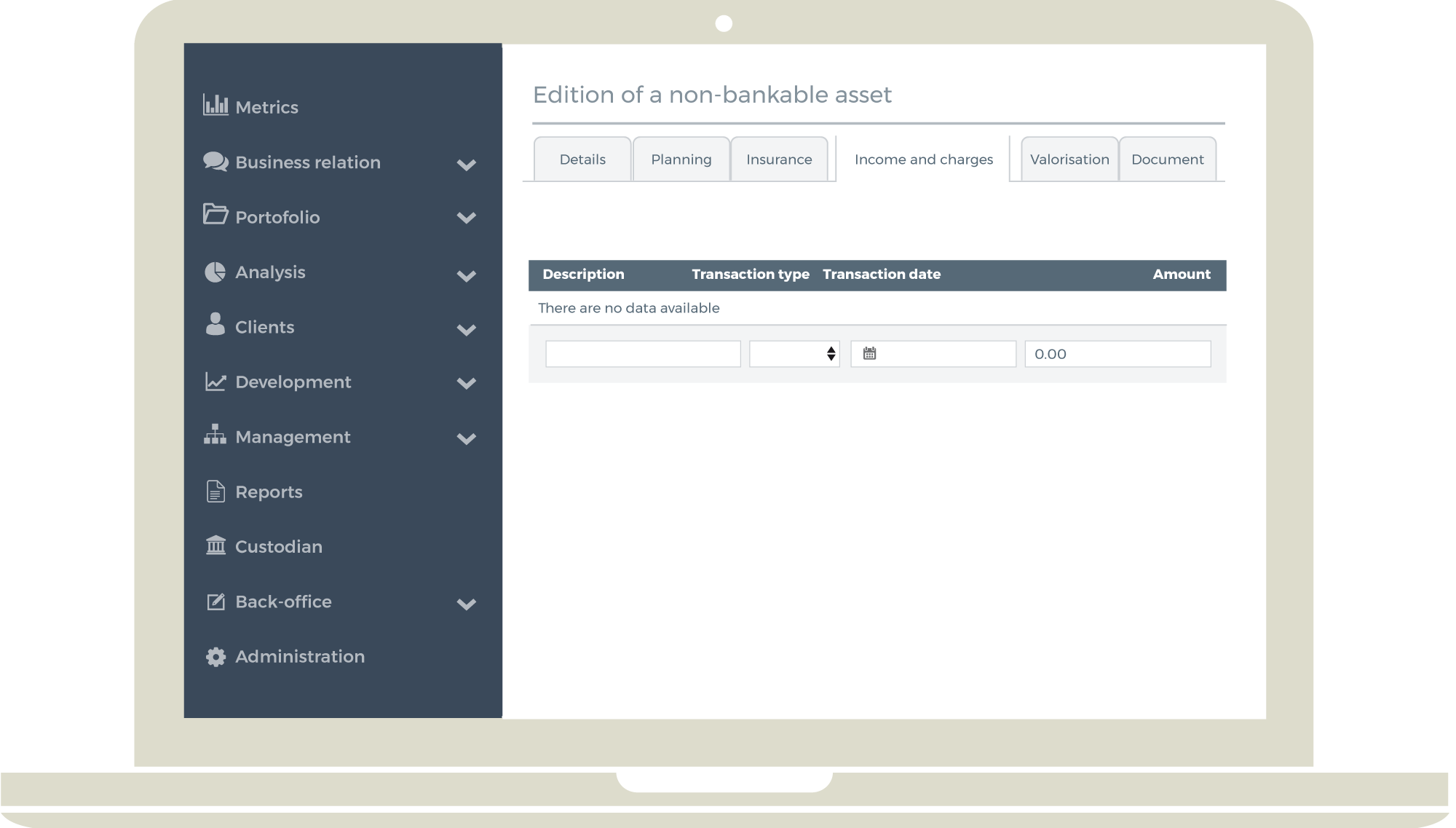

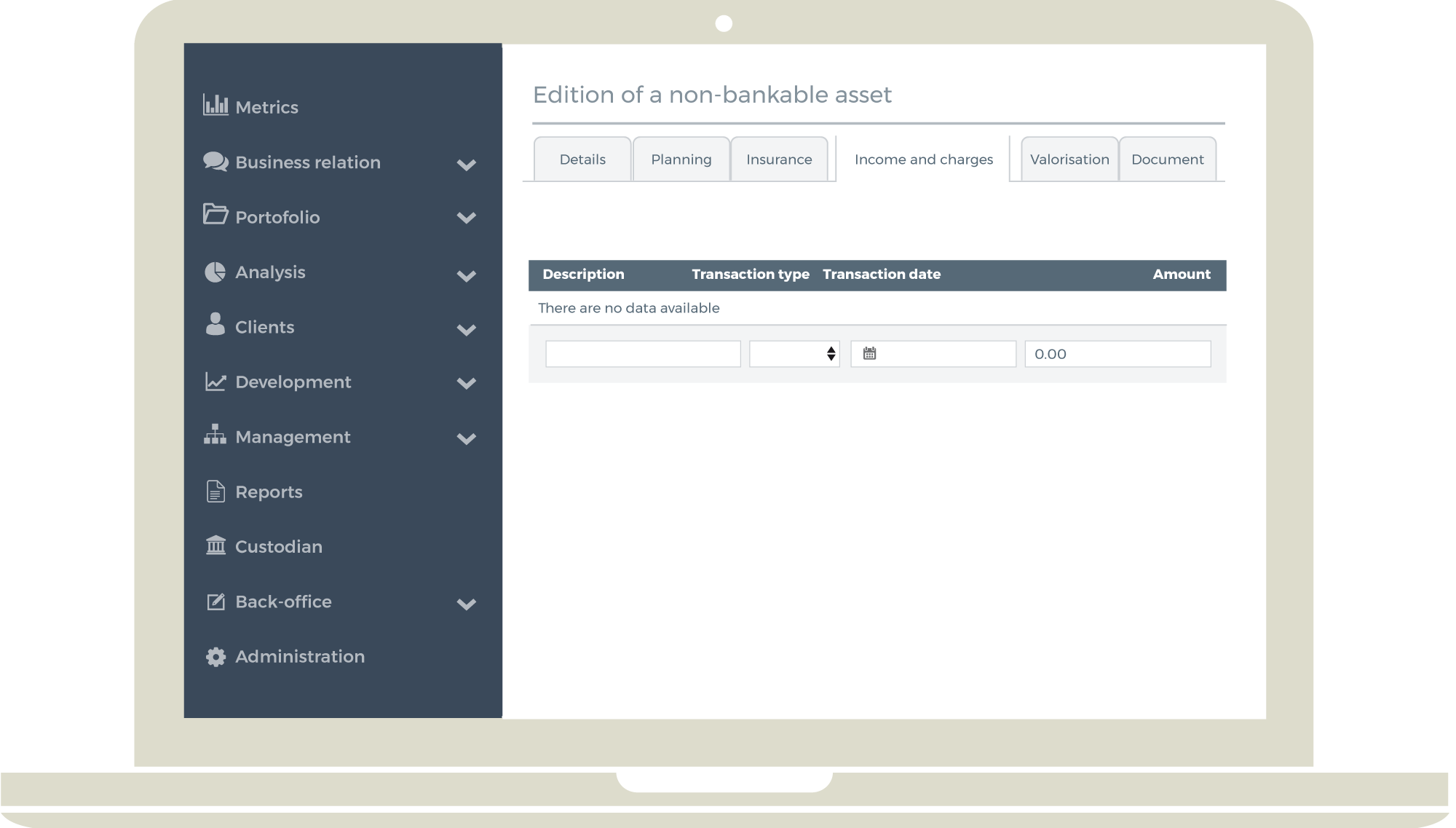

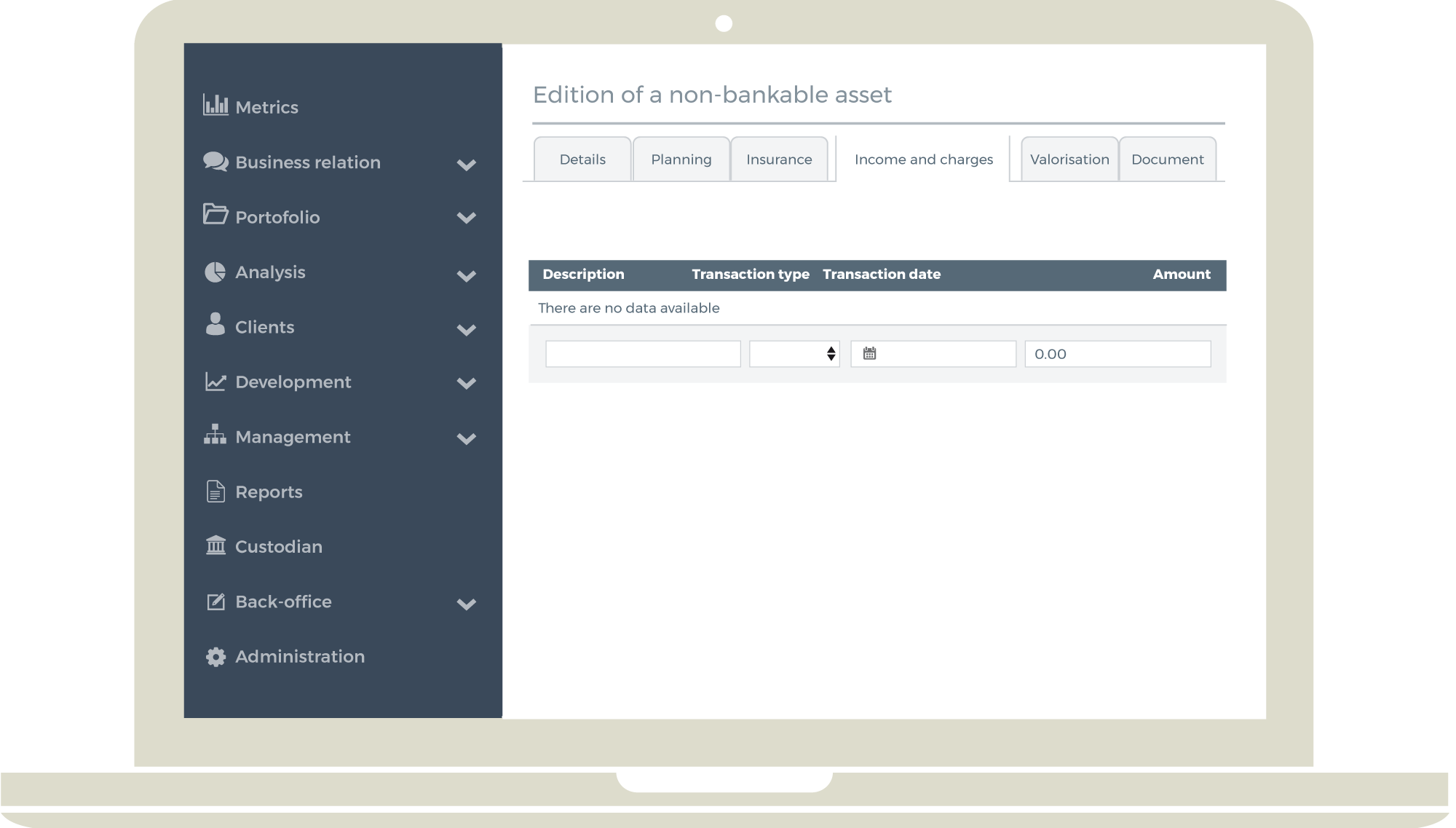

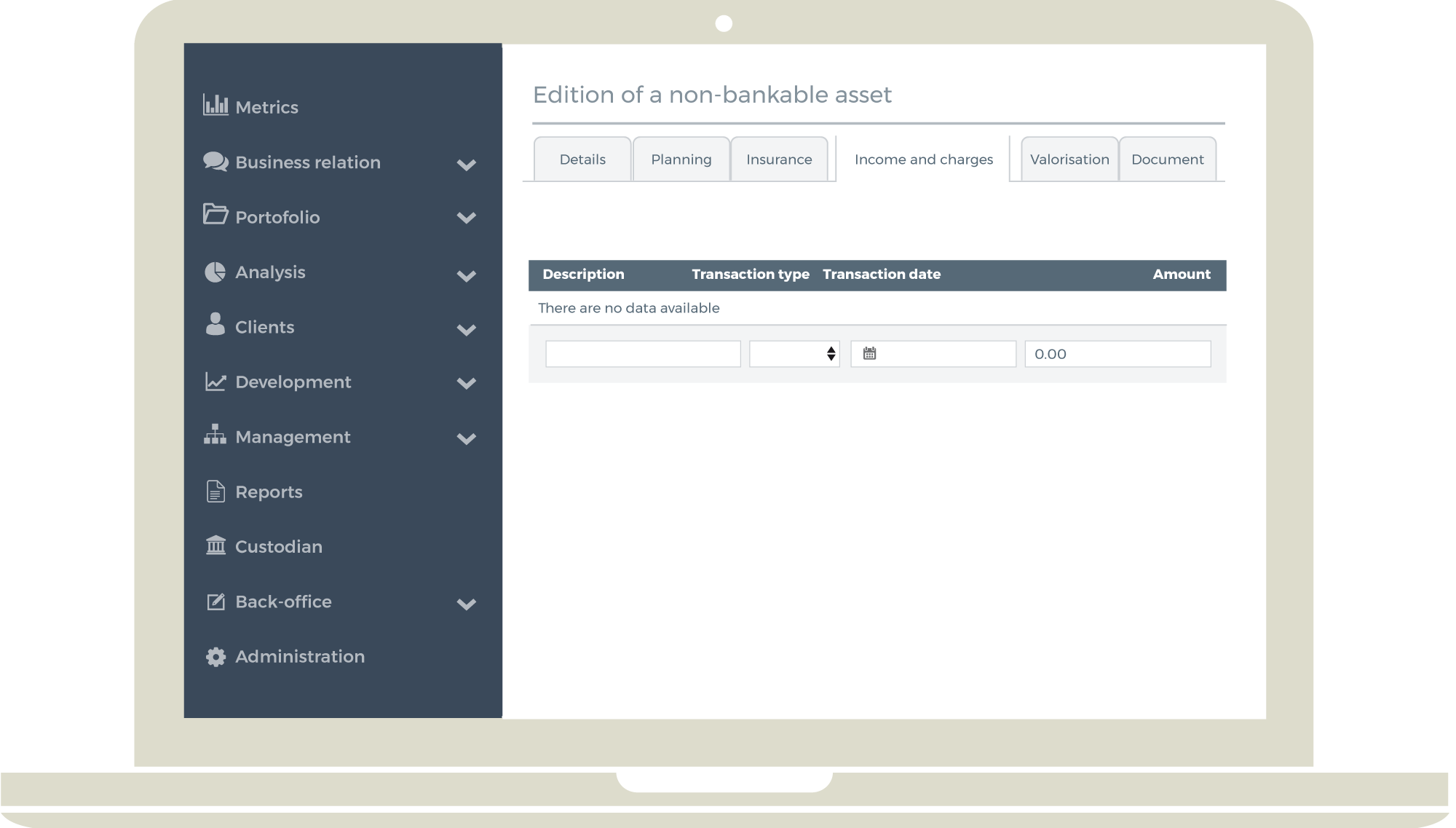

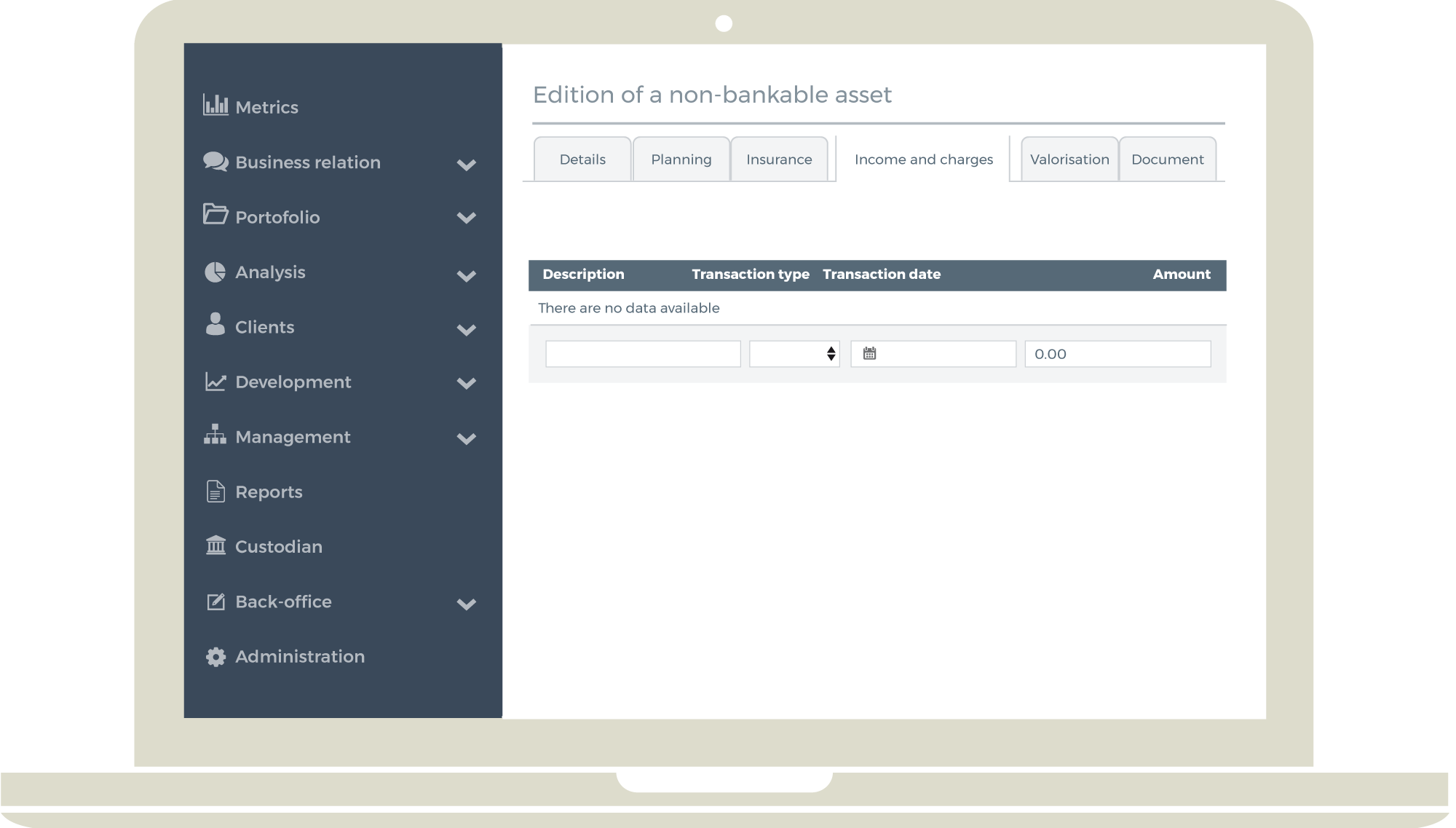

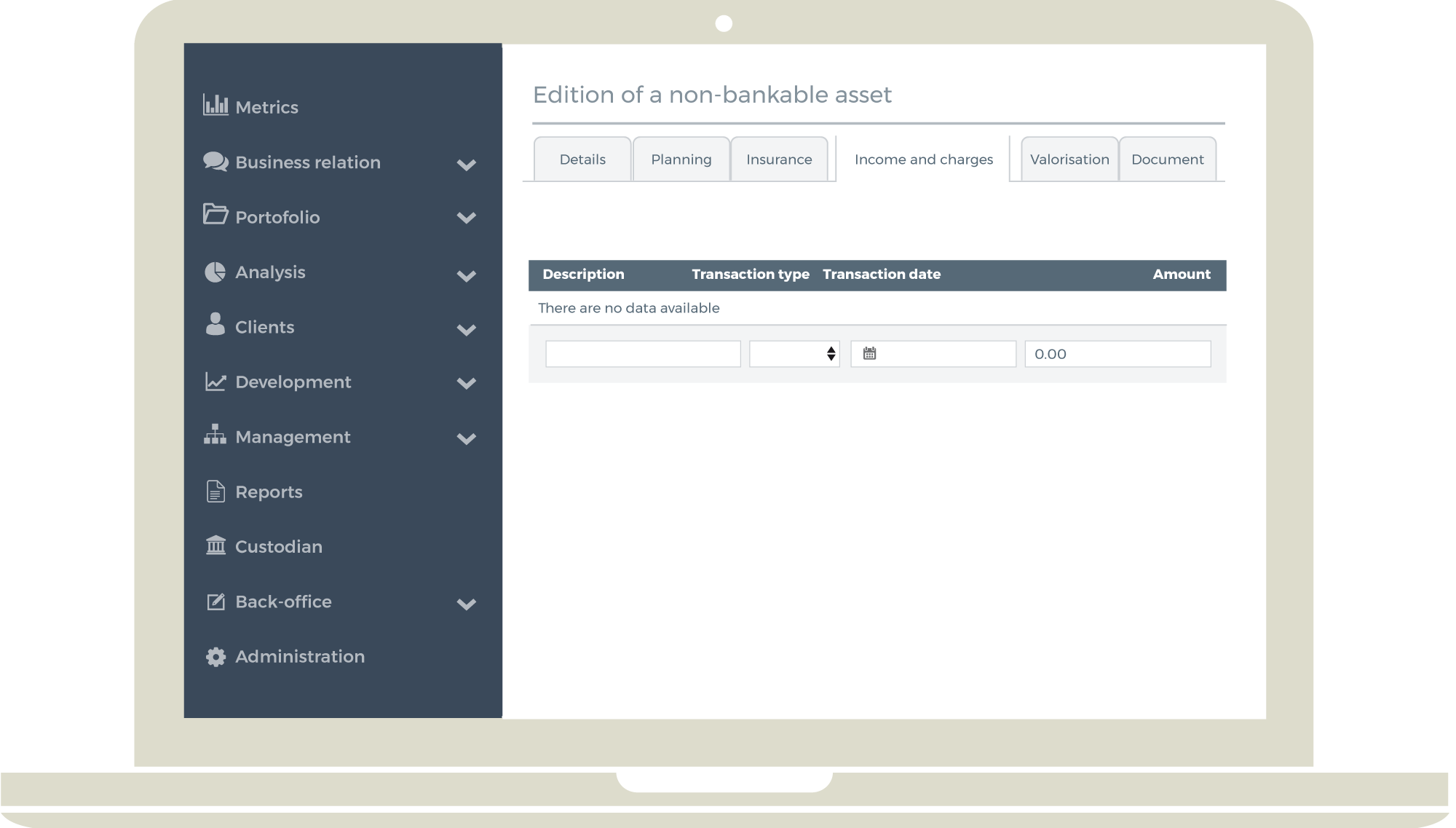

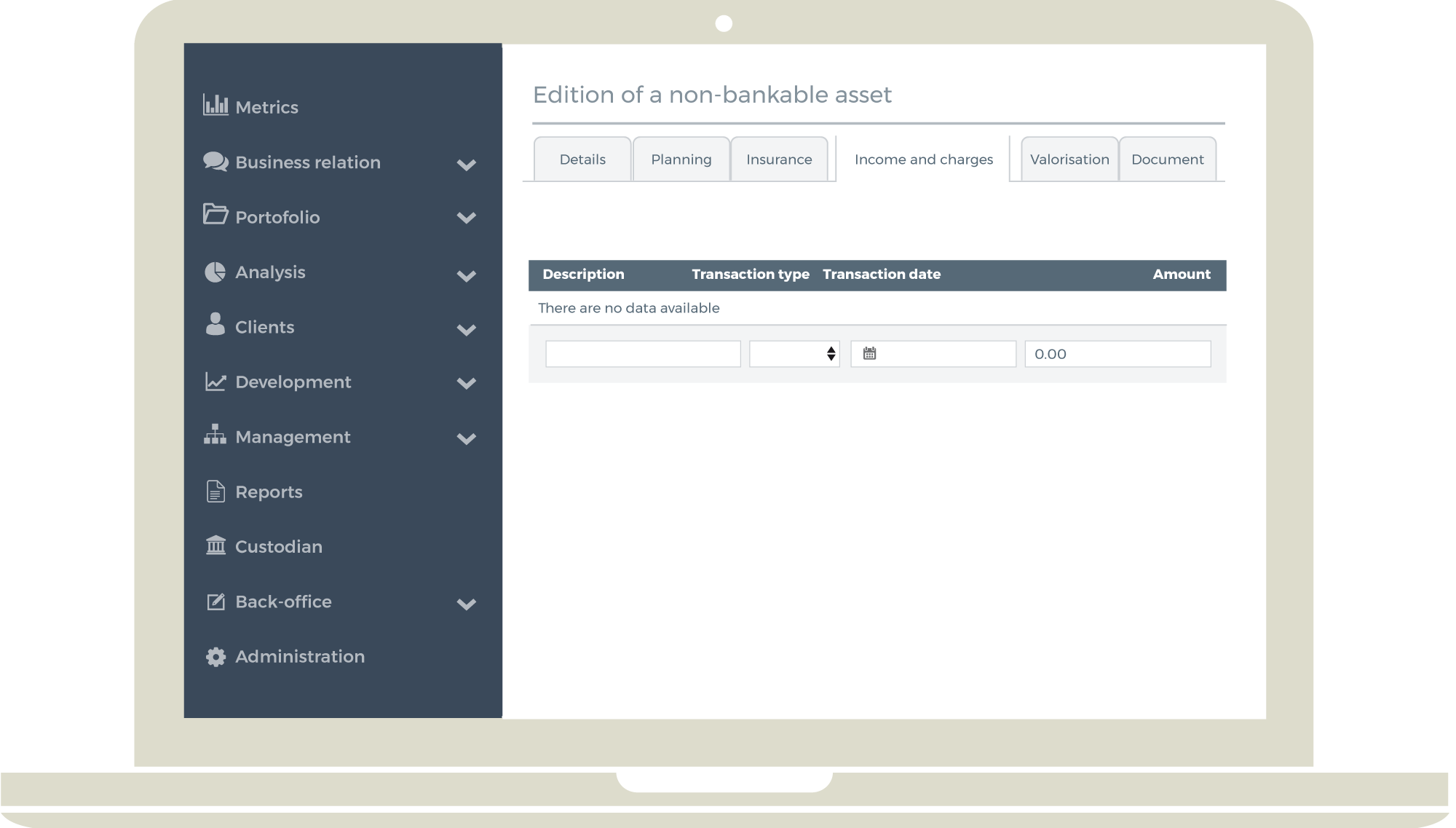

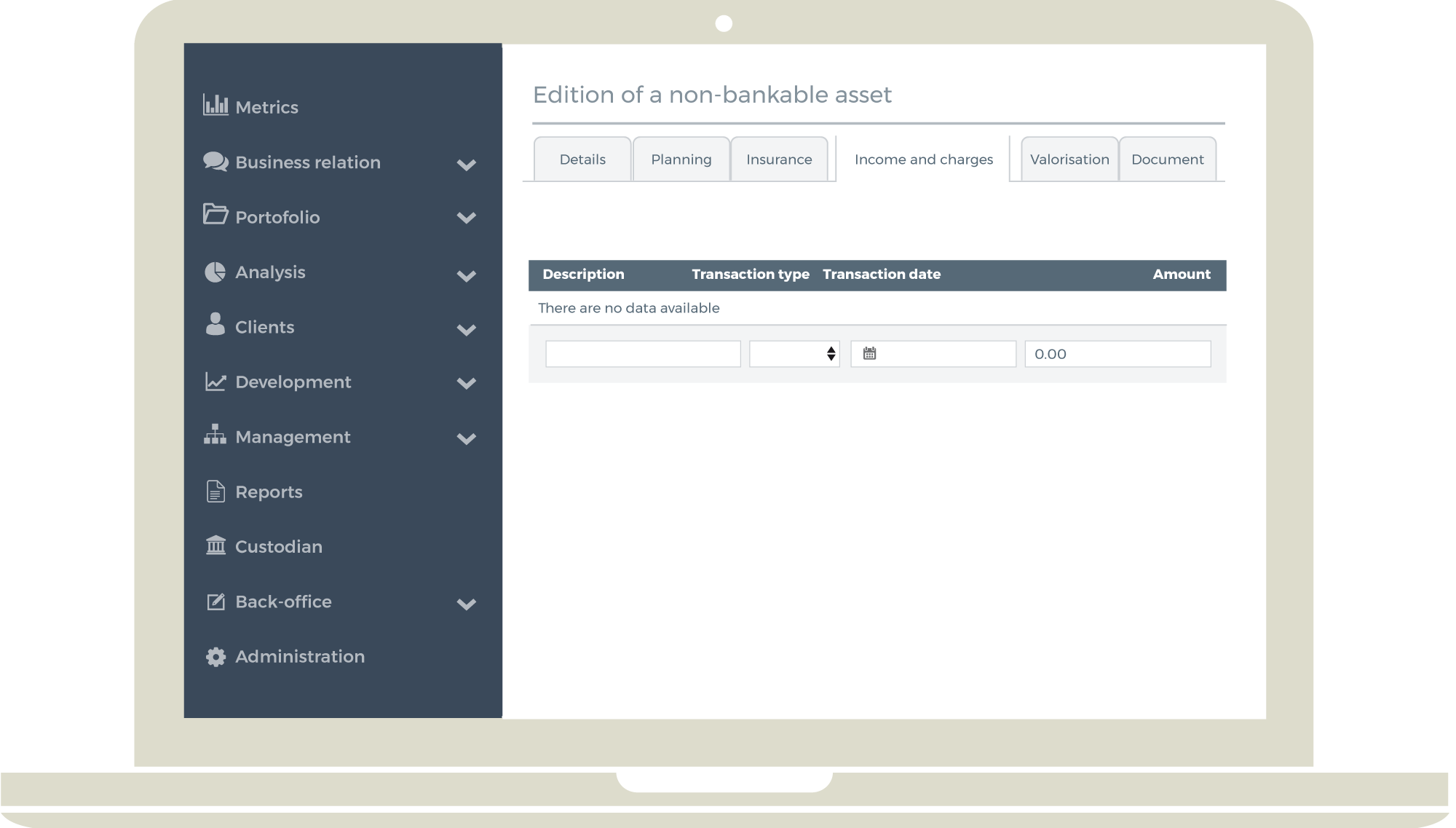

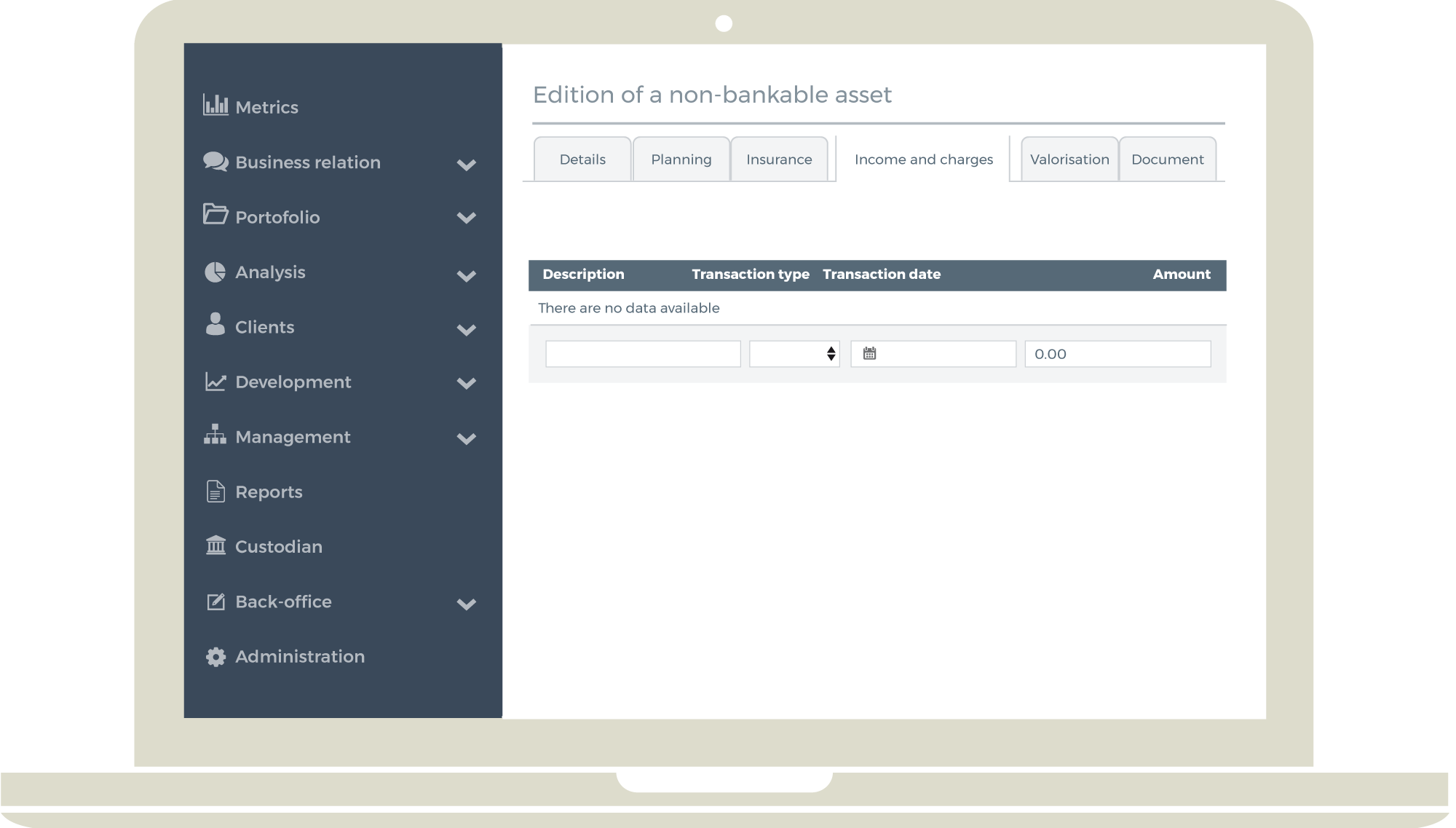

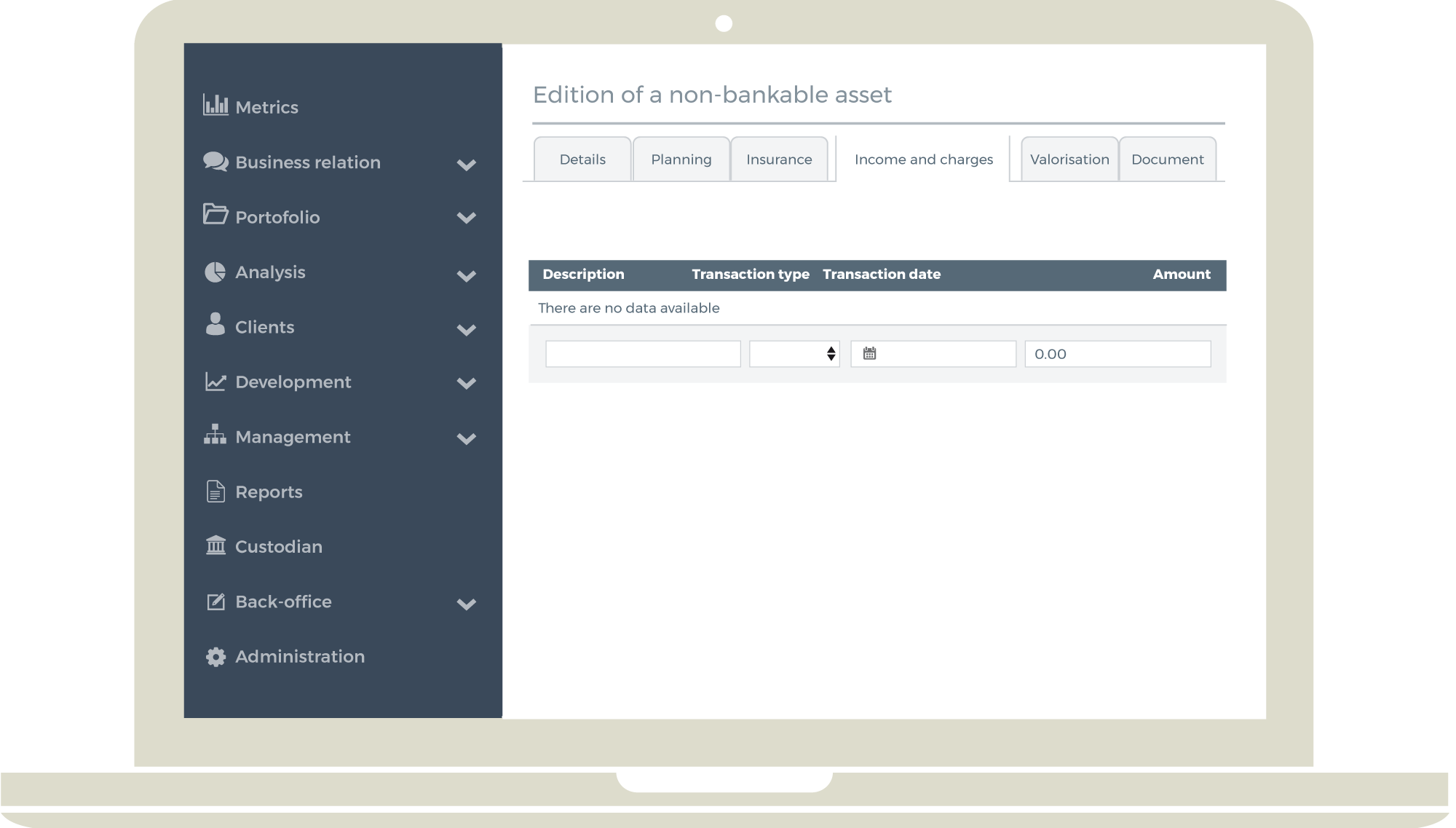

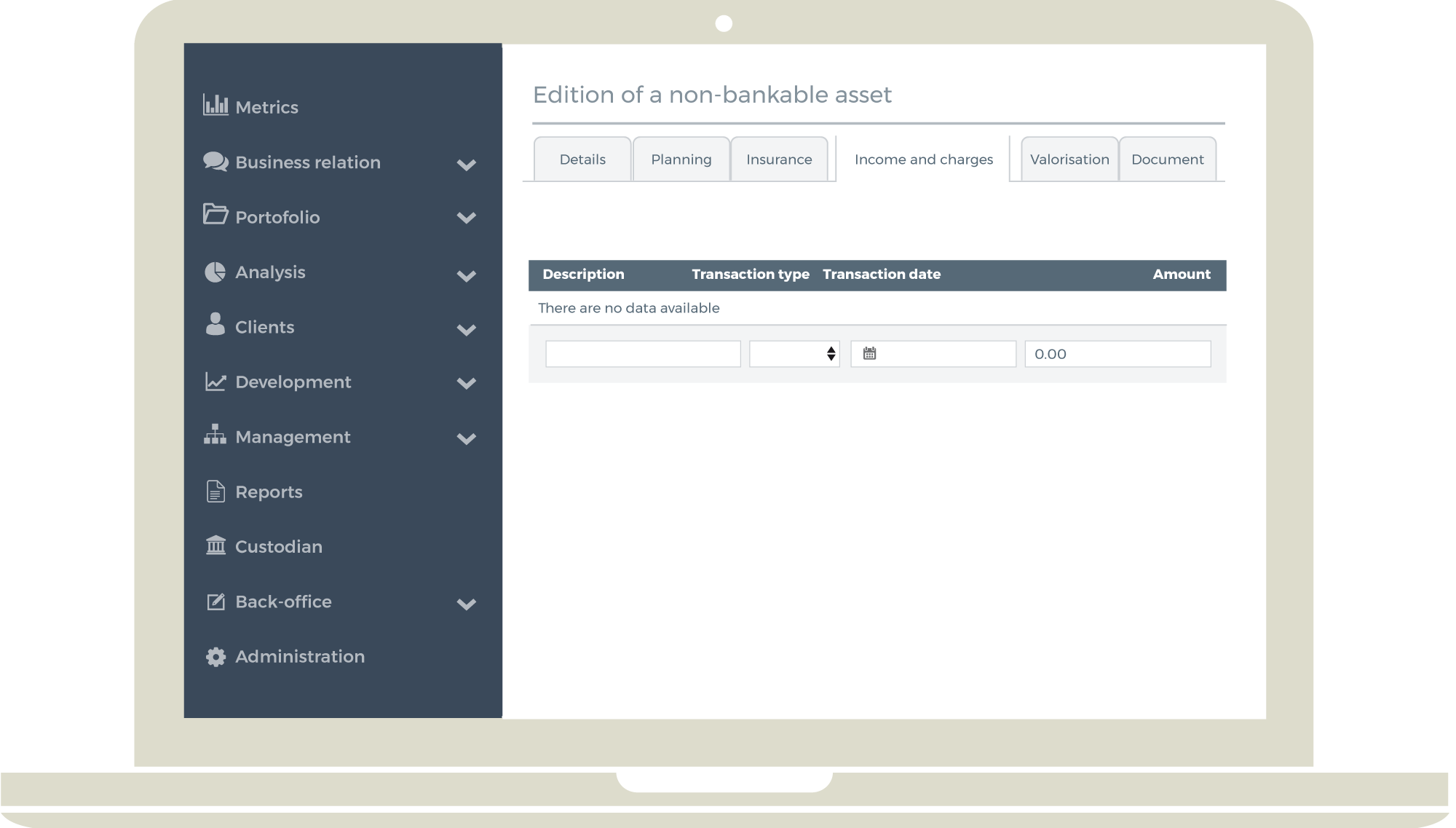

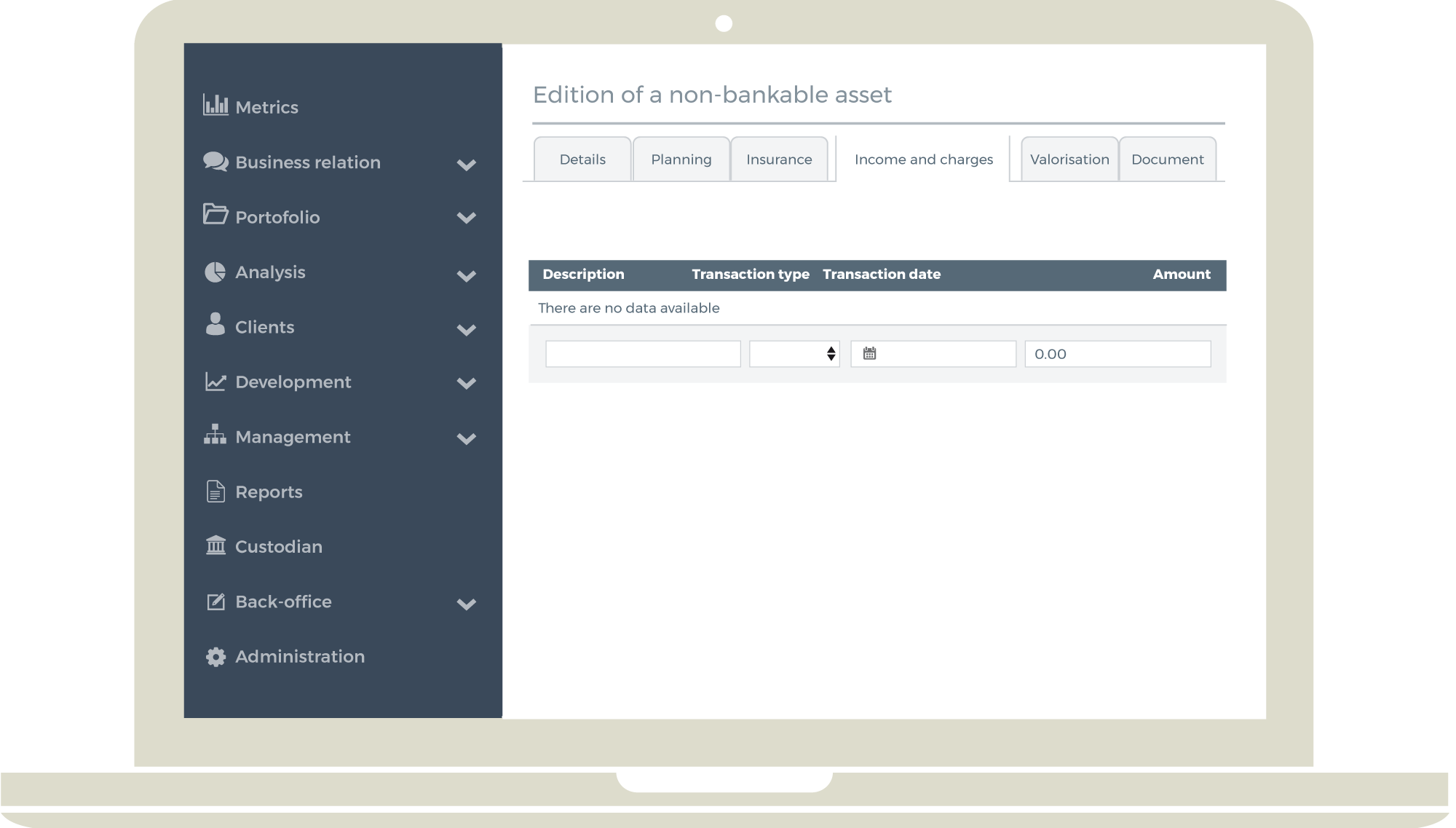

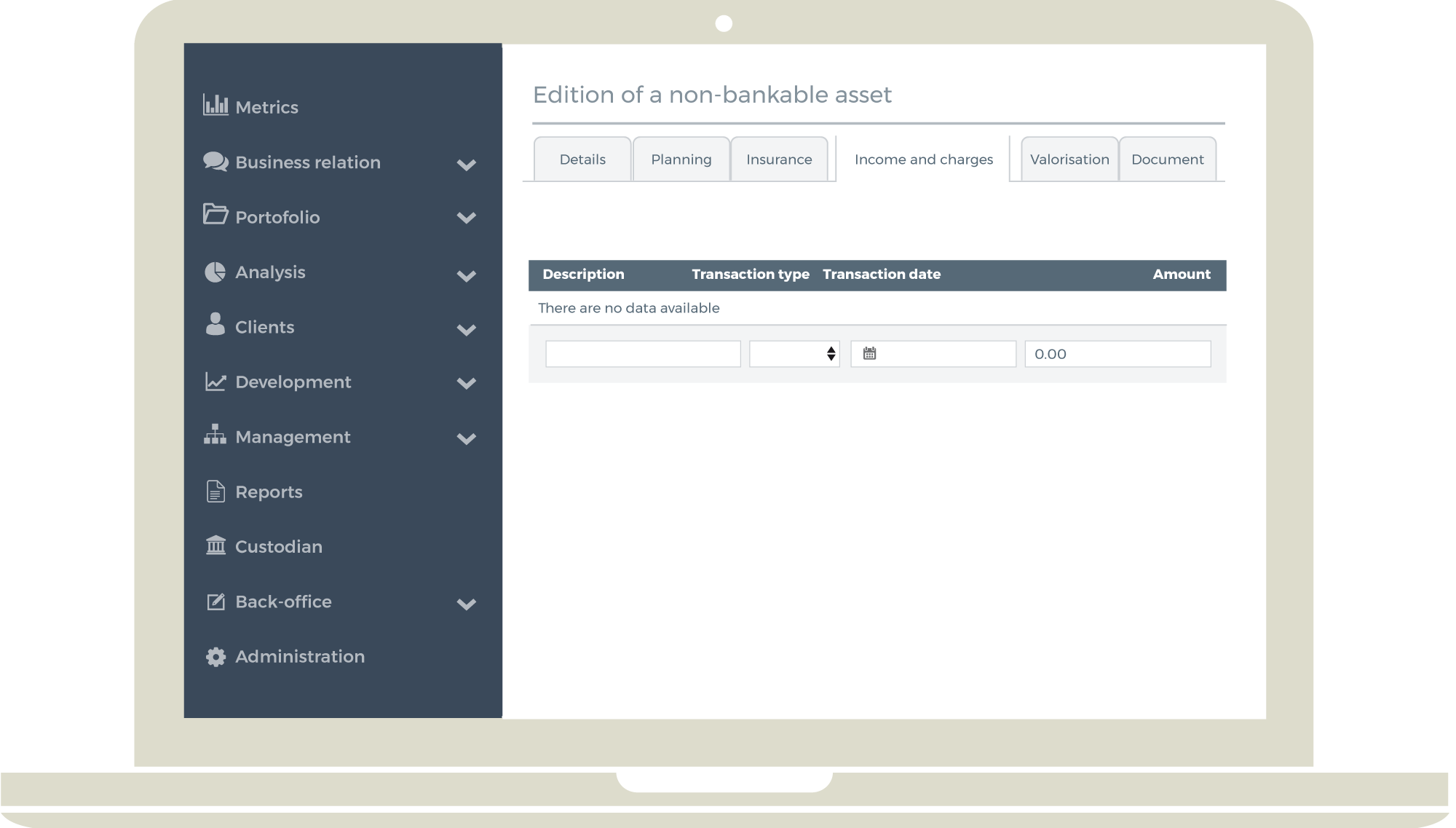

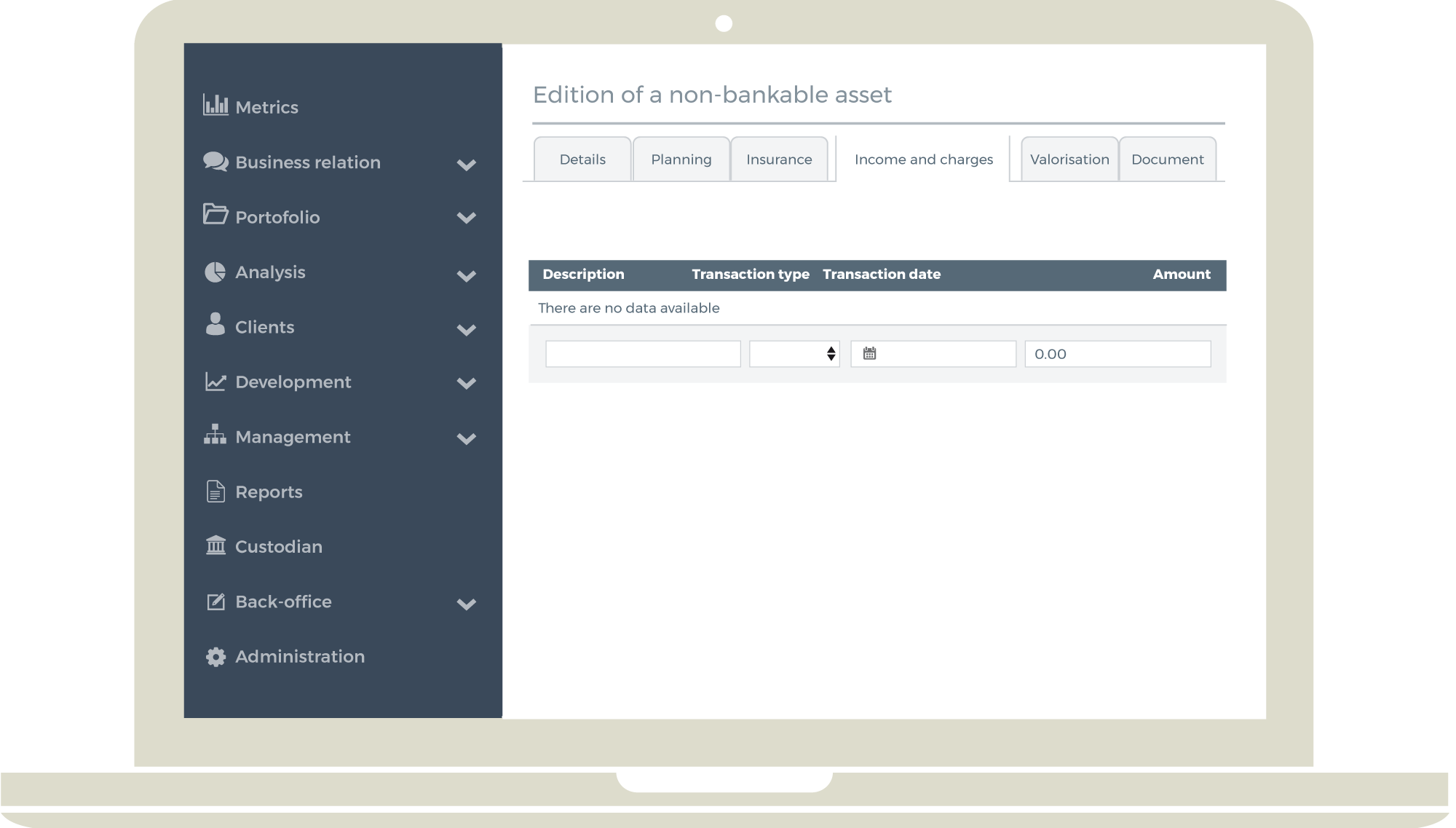

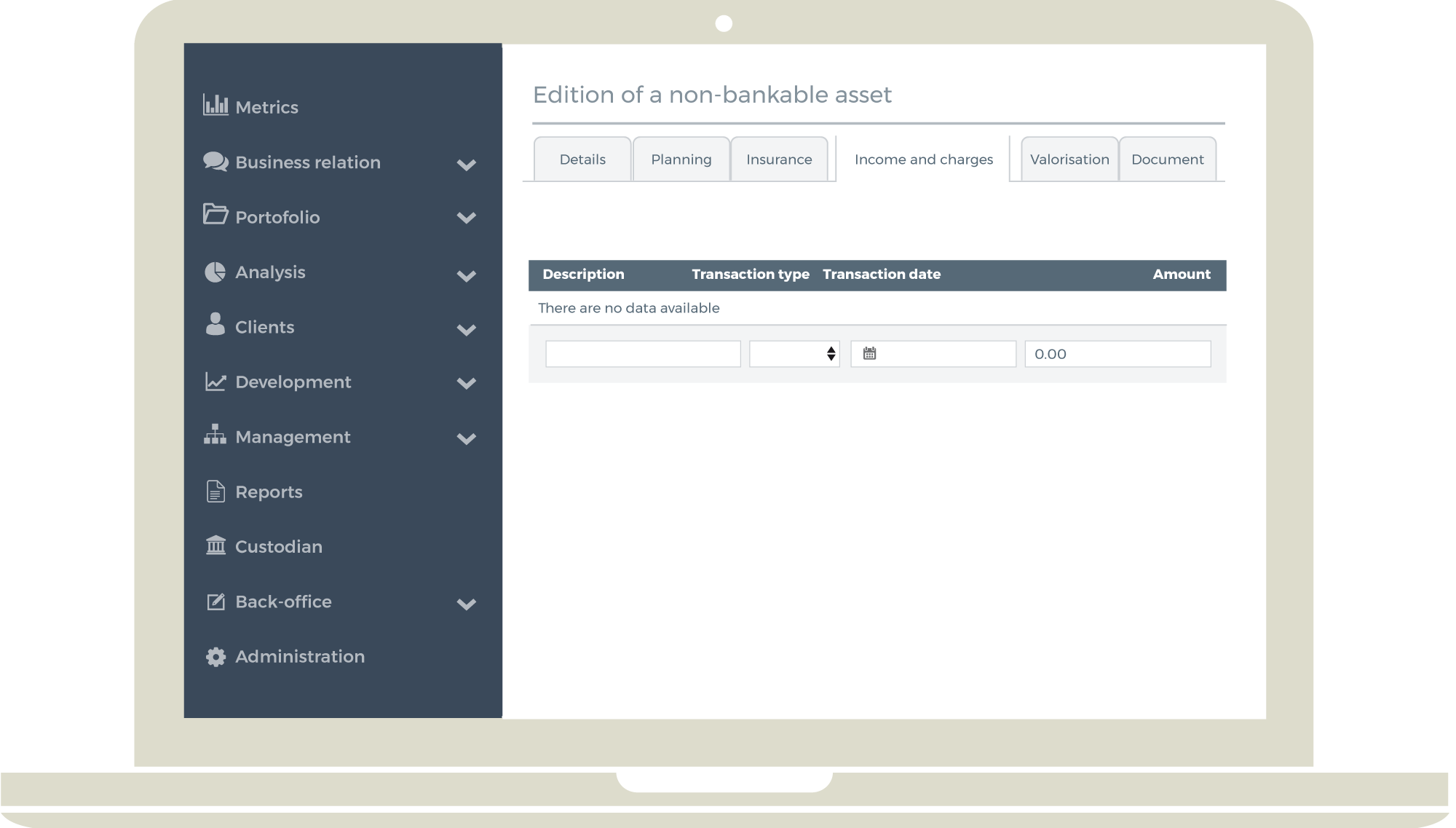

Create a non-bankable asset

Tutorial

Activity report

Tutorial

Billing

This tutorial is necessary for billing. It is necessary to check that certain data are present in the software to start a billing.

Tutorial

Create a task

Tutorial

Linking a client to a portfolio

This tutorial is necessary when you want to add a client to a portfolio as a Holder, Economic Owner, Viewing Right, Procured.

Tutorial

Manage Retrocessions

This tutorial is necessary to manage retrocessions on Custodian Banks, Investment Funds and Structured Products. It also helps to dispatch retrocessions to all related portfolios and figure out their impact on the portfolio performance.

Tutorial

Using the DowJones function

Efficience works with several partners who offer you the possibility to add new features to the program. DowJones is one of them. With the DowJones Option, you can do some researches about your clients and check if they are risky clients (if they are PEP, if they have legal troubles, etc.). Here is the tutorial to teach you how to use it through Efficience.

Tutorial

Create a Life Insurance

This tutorial teaches you how to create a life insurance in Efficience.

Tutorial

Create a model portfolio

This tutorial teaches you how to create a model portfolio, how to link it to a portfolio and finally how to use it in an investment simulation.

Tutorial

Create Investment Simulations

This tutorial teaches you how to create investment simulations based on an existing portfolio, for prospect or consolidated investment simulation based on the consolidated holdings of a client.